Peg ratio formula

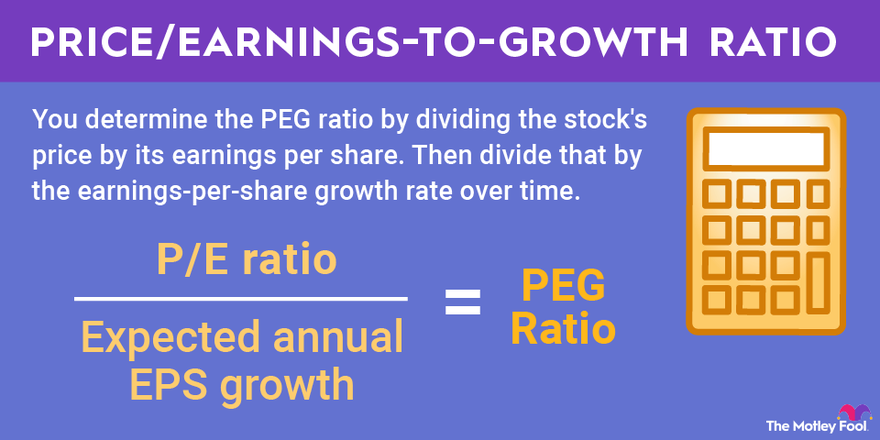

Current Price Per Share. The PEG ratio is a good way to value a stock while taking its growth rate into account and investors should be familiar with how the PEG ratio formula works.

Peg Ratio Formula How To Calculate Price Earnings To Growth

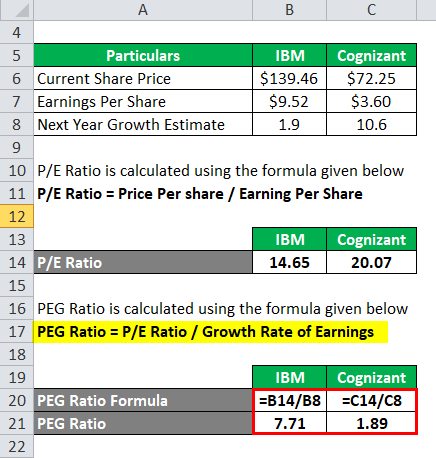

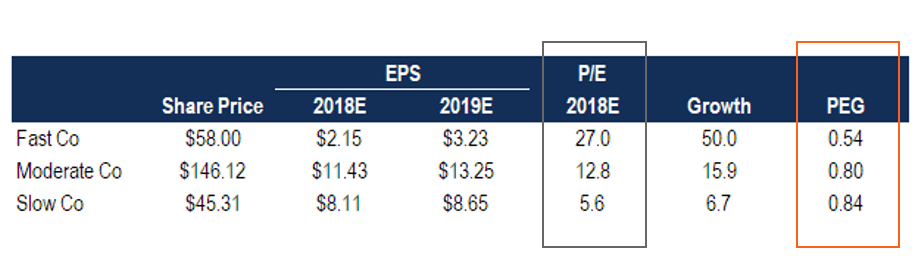

As mentioned previously it denotes the ratio between a stocks PE ratio and its projected growth in earnings.

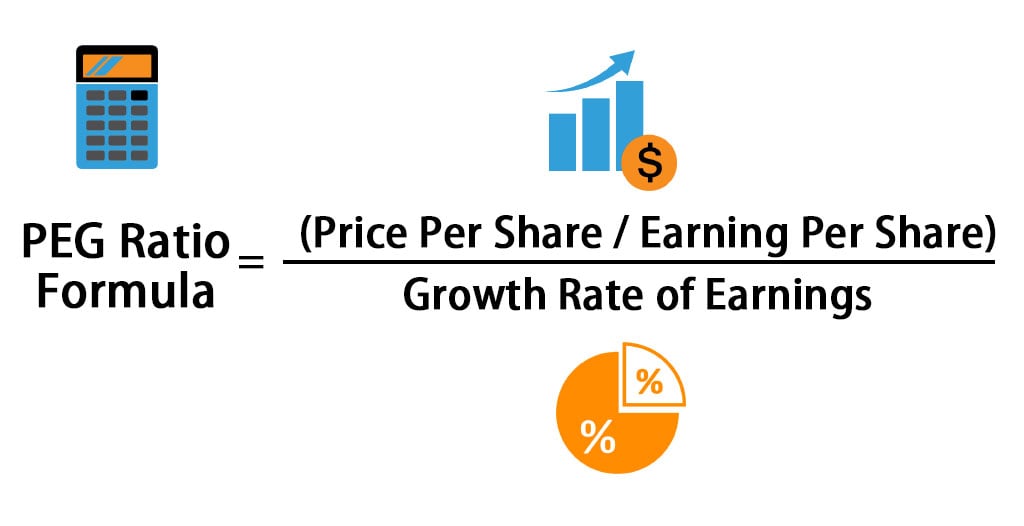

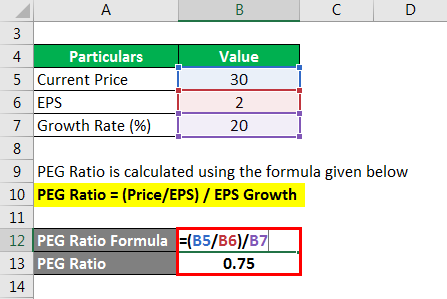

. What is considered a good priceearnings-to-growth ratio. PEG Ratio PE Ratio Forecasted EPS Growth. The formula is.

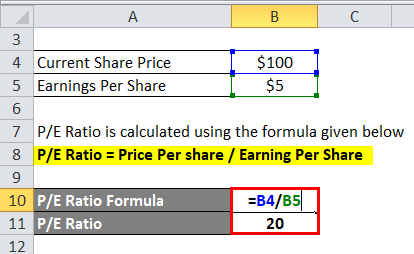

Here is the PEG ratio formula used to check if the stocks are appropriately priced. PE Ratio Current Price Per Share Earnings Per Share. PE ratio 202 10.

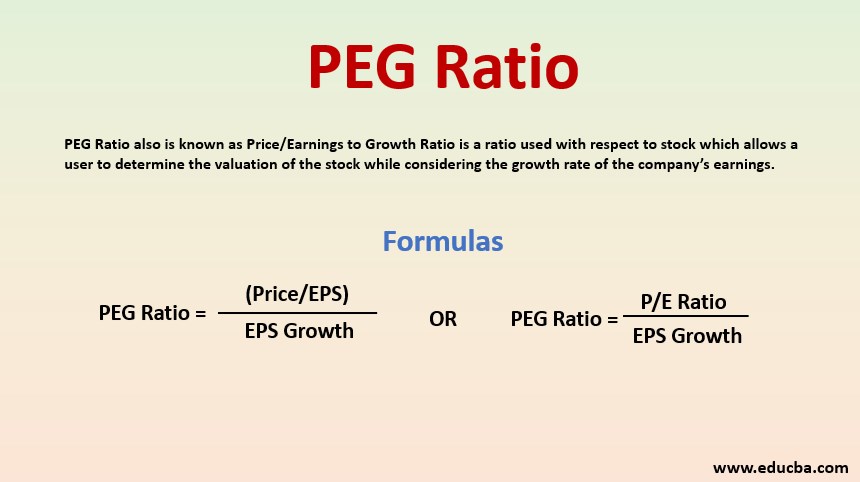

The price-earnings ratio PE ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings. A variation of the price-to-earnings ratio where a stocks value is further evaluated by its projected earnings growth. The PEG ratio can be calculated by taking the PE ratio and dividing it by the earnings growth rate.

Price-Earnings Ratio - PE Ratio. The formula for calculating this ratio looks like this. The priceearnings-to-growth PEG ratio addresses one of the primary weaknesses of the price-to-earnings PE ratio which is the lack.

EPS here is the Earnings Per Share for the companies. Price Earnings to Growth Ratio PE Ratio EPS Growth Rate. A PEG ratio calculation is a stock valuation measure used by analysts and investors.

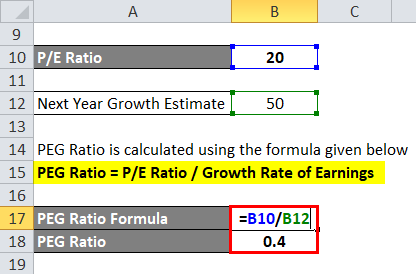

The formula for calculating the PEG ratio is simple. PEG ratio 1020 05. PEG PE Ratio Annual Earnings per Share Growth Rate.

The PEG ratio is calculated using the following formula. Just divide the priceearnings ratio by the earnings per share growth rate. Price Earnings Growth Ratio PEG Price Earnings.

PriceEarnings to Growth and Dividend Yield - PEGY Ratio. The PEG ratio formula entails the priceearnings to growth ratio. Similar to the PE ratio with this ratio you have.

It shall be noted that the PE ratio thus considered for PEG ratio is the trailing. For example if a company has a PE ratio of 15 and an earnings growth rate of 30 then the. If the priceearnings-to-growth ratio.

PriceEarnings-to-Growth PEG Ratio Definition. In the example above if the investor only considers the PE ratio for valuation purposes he will determine that the stock. The PEG ratio is a shortcut for.

The PEG ratio priceearnings to growth ratio is a valuation metric for determining the relative trade-off between the price of a stock the earnings generated per share and the companys. Analysts and investors use this PEG.

Peg Ratio Definition Equation Calculation

Peg Ratio Example Explanation With Excel Template

Peg Ratio Formula How To Calculate Price Earnings To Growth

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Peg Ratio Price Earnings To Growth Formula And Calculator Excel Template

Peg Ratio Formula How To Calculate Price Earnings To Growth

Peg Ratio Breaking Down Finance

What Is The Peg Ratio

Peg Ratio Price Earnings Growth Ratio What It Really Means

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

Peg Ratio A Combination Of Pe Peg To Value Indian Stocks Getmoneyrich

What Is Peg Ratio Quora

Peg Ratio Formula How To Calculate Price Earnings To Growth

Peg Ratio Example Explanation With Excel Template

What Is Peg Ratio Yadnya Investment Academy

Peg Ratio Vs Price To Earnings P E Ratio Youtube

Peg Ratio Price Earnings To Growth Formula And Calculator Excel Template